|

Disclaimers: USA Only | Guide is For Celsius Earn Accounts | Do Your Own Research IntroductionThe Celsius bankruptcy has impacted hundreds of thousands of people. While many are happy to have received distributions, the tax impact is quite complex. I have scraped the internet looking for a reputable and comprehensive guide detailing exactly how to handle the distributions. To my surprise, I have not found a guide that is both reputable and comprehensive. All reputable guides are over simplified, gatekeeping the actual details of the complex calculation, and all detailed guides are generally not reputable and contain errors. I’m here to set the record straight and provide an in-depth guide to calculating the tax impact of the Celsius bankruptcy and subsequent distributions based on my interpretation of the guidance. This will be a long post, but will contain the granular details needed for any of you looking to perform this calculation on your own. For context, my name is Justin and I am a CPA specializing in crypto taxation. Without further adieu, let’s begin. Ponzi Scheme vs Capital Loss RouteThere are two options for claiming a loss here. (1) Ponzi scheme loss and (2) Capital loss.

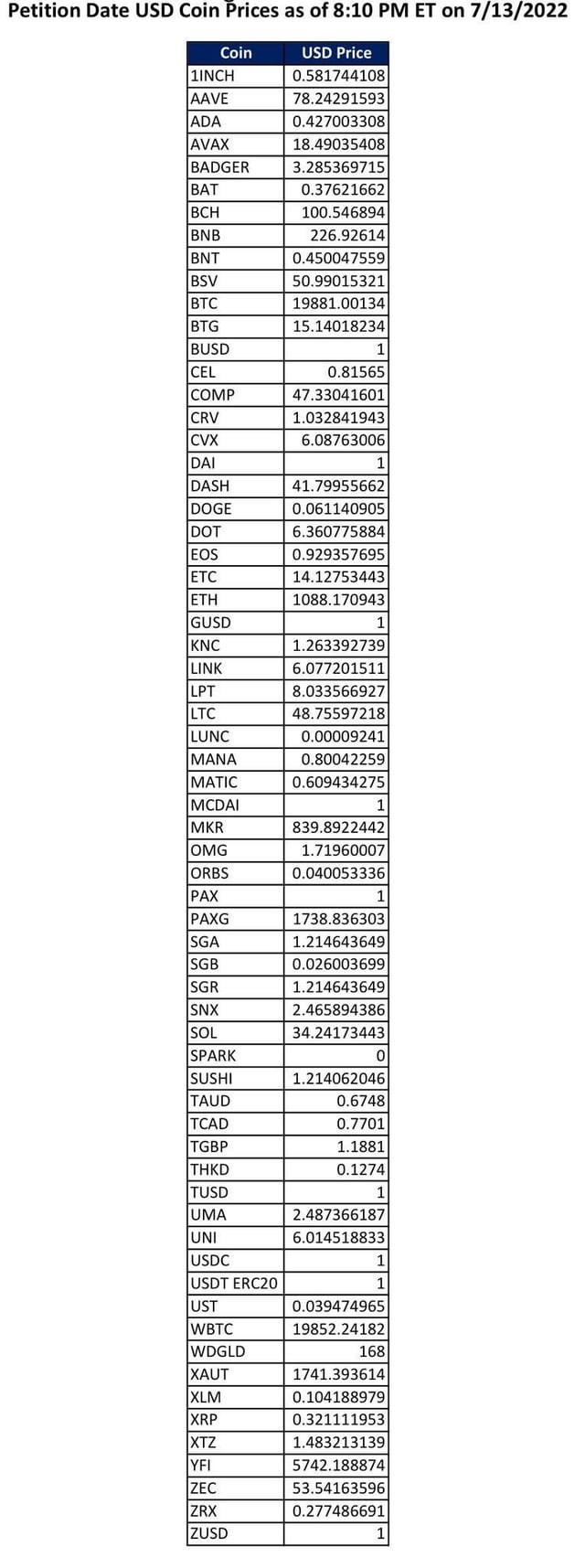

For purposes of today’s post, I will be focusing on the Capital Loss route and how to calculate the tax impact of the distributions given that the majority of people will fall into this bucket and likely haven’t begun to think about this calculation yet since it won’t be required to be made until 2024 tax filing in April 2025. Understanding Your Claim ValueYour claim value is based on (1) the crypto assets lost (type and amount), (2) the values of the tokens at 8:10 PM ET on 7/13/2022 per the bankruptcy document, and (3) whether or not you opted out of the class action settlement. Take all your lost tokens and multiply the amount by the values in the above screenshot. This is your initial claim value. Unless you specifically opted out of the class action settlement, your claim will automatically receive a 5% mark up. So if you did not opt out of the class action settlement, multiply your initial claim by 1.05. This is your final claim amount that your distributions will be based off of. Distribution Payout StructureNow that you know your claim value, we can begin to understand the distributions received. Celsius hopes to distribute 79.2% of each person’s claim amount, leaving 20.8% of your claim likely unrecoverable. The breakout of how these distributions will be split is below.

The BTC, ETH, and Stock distributions are to occur in 2024, with the “effective date” set as 1/16/2024. This date is the date used in determining the fair value of the distributed assets. The following values must be used in the calculation for the received BTC, ETH, and stock.

The remaining 6.4% distribution date is unknown. It could be in 2025, or it could be in a decade. The additional 20.8% that is likely unrecoverable won’t be factually established as unrecoverable until the court proceedings are finalized, which again could take a decade. Understanding Your Maximum LossBefore we get into the actual calculation, it’s important to nail down the concept of your maximum loss. This is high level and just to set the fundamentals before getting into the details. Taking a step back, your maximum loss is equal to the cost basis of assets lost. Period. Your max loss will never be more than your cost basis (the fair value of assets lost does not influence your maximum loss). Your maximum loss is not the same as your claimable loss. The maximum loss is just a starting point. The fair value of any assets subsequently received in a distribution will decrease this loss. In other words, if no distributions were made, the loss you can claim is equal to your maximum loss aka the cost basis of the assets lost. The formula is simple. Maximum Loss – Fair Value of Distributions = Claimable Loss. Let’s use an example. Example: Cost basis of assets lost (maximum loss) = $500. In total, you receive distributions totaling $200 in fair value at the time. The loss you can claim is… $500 – $200 = $300 claimable loss. This concept should hopefully be fairly straight forward. What if the fair value of what I received is more than the cost basis of assets lost? In a scenario like this, you actually have a gain on the distribution. Let’s look at another example: Example: Cost basis of assets lost (maximum loss) = $100. In total, you receive distributions totaling $200 in fair value at the time. Using the same formula… $100 – $200 = -$100 aka a $100 GAIN. In the above scenario, since you received assets worth more than the cost basis of the assets lost, you actually are in a gain position. This is common for those who bought crypto early on and simply held for a long time. It’s important to note, the amount of crypto lost vs received is irrelevant, it is solely based on the dollar value of cost basis vs dollar value of distribution. Understanding Taxable Event TimingNow that we have the fundamentals down for your maximum loss vs your claimable loss (or gain), we need to dive deeper into the timing of when these losses/gains need to be recognized. Simply put, a taxable event only occurs when a distribution is made (or its determined no more distributions will be made). Therefor, the gains/losses will be recognized when (1) the 2024 distributions were made, (2) the 6.4% distribution from the sale of illiquid assets is made at some time in the future, and (3) when the court proceedings finalize and it is factually established the 20.8% remaining amount will not be recovered. Understanding Forced LiquidationWhen Celsius went bankrupt, all assets on the platform were frozen. No withdrawals or trades could be made. For ease of understanding, you can imagine these assets simply sat locked up in a wallet doing nothing at all. In order to fund the distributions of BTC, ETH, and stock (and any future distributions), these assets will be sold. This is known as a “forced liquidation”. However, for tax purposes, until that point they simply sit untouched. This is why the taxable event does not occur until the distribution is made as the forced liquidation does not occur until that point. Understanding Non Like-Kind DistributionsWhile many people lost BTC and/or ETH on Celsius, there are some who held neither on the platform. Since they did not hold BTC or ETH, receiving the BTC and ETH (and stock) would be considered a non like-kind distribution and result in a forced liquidation (taxable event). In these scenarios, the calculation is quite a bit easier than the scenarios where a user held BTC and/or ETH. Before we get into the nuances of distributions of like-kind assets, let’s do a high level break down of how to calculate the loss/gain realized when a user did not hold either BTC or ETH. Using the percentages from the “Distribution Payout Structure”, allocate your total cost basis of lost assets to each. For example, 28.95% of your total cost basis should be allocated to BTC, 28.95% of your total cost basis should be allocated to ETH, 14.9% of your total cost basis should be allocated to Stock, 6.4% of your total cost basis should be allocated (reserved) for the future distributions from the sale of illiquid assets, and 20.8% of your total cost basis should be allocated (reserved) for the likely unrecoverable amount (yes, this means that amount won’t be able to be recognized as a loss until the court proceedings complete, which could be years). Now that you have allocated your total cost basis of lost assets to each of the distribution categories, you can begin to calculate the loss/gain recognized for the 2024 distributions by using the formula mentioned in the “Understanding Your Maximum Loss” section. Let’s look at an example. Assume the only asset you lost was 1,000 USDC on Celsius with a cost basis of $1,000. Your claim value is $1,050 (5% markup for not opting out of the class action settlement). Of that cost basis, $289.5 is allocated to BTC distribution, $289.5 is allocated to ETH distribution, $149.5 is allocated to Stock distribution, $64 is reserved for future distribution from sale of illiquid assets, and $208 is reserved for the amount that is likely unrecoverable (and can only be claimed once proceedings finalize). In 2024, you receive $303.98 worth of BTC (28.95% x $1,050), $303.98 worth of ETH (28.95% x $1,050), and $160 worth of Stock (14.9% x $1,050, rounded to nearest share). In this scenario, you actually have a gain. Below is the calculation.

To summarize, the loss/gain calculated for each distribution is equal to the fair market value of the assets received (using the effective date price) minus the cost basis allocated to that distribution. Understanding Like-Kind DistributionsAs mentioned above, most people held either BTC or ETH on Celsius at the time of bankruptcy in addition to other assets. Given the fact that part of the distribution was made “in-kind”, a forced liquidation does not actually occur. In other words, if you had BTC and/or ETH stuck on Celsius, and since part of the distribution is being paid in BTC and ETH, the amount returned can be viewed as simply a transfer off of Celsius with no forced liquidation (and thus no taxable event). With that said, this is where the calculation can get quite complex. There are a few things to consider here.

For simplicity sake, the BTC/ETH received will fall into one of two buckets, “Returned” or “New”. These names will be important to continue following along.

Calculating Loss/Gain On DistributionsIf you’ve made it this far, then you’re almost there. However, this is the most complicated step but hopefully with a few examples you’ll be able to follow along. In order to calculate your loss/gain on the distributions, I’ve created the step-by-step process below.

Using these steps, you will be able to effectively allocate the cost basis of assets lost on Celsius to the 7 different categories (BTC “Returned”, BTC “New”, ETH “Returned”, ETH “New”, Stock, Sale of Illiquid Assets, Likely Unrecoverable) and calculate your realized gain or loss in 2024 and future years using the fair value of the distributions received. A few examples might help. Example #1 – Received Less BTC and Less ETH Than Initially LostScenario: You lost 1 BTC, 5 ETH, and 50,000 USDC with cost basis of $10,000, $5,000, and $50,000 respectively ($65,000 total). Your total claim is $84,800.85 calculated using the petition prices linked in the “Understanding Your Claim Value” section with the 5% markup added. You receive 0.571285 BTC, 9.526521 ETH, and 632 shares of Ionic stock in 2024. Follow the steps. Step 1) Identify “Returned” BTC and ETH vs “New” BTC and ETH Returned BTC = 0.571285, New BTC = 0, Returned ETH = 9.526521, New ETH = 0. Step 2) For “Returned” BTC/ETH, Identify Cost Basis Returned After manually looking at your tax lots of the crypto lost on Celsius, you determined the returned BTC has a cost basis of $7,000 and the returned ETH has a cost basis of $4,500. Step 3) Identify Remaining Cost Basis to be Allocated $65,000 total cost basis – $7,000 – $4,500 = $53,500 remaining Step 4) Determine Starting Percentages for Allocation for Remaining Categories

Step 5) Calculate the Final Percentages for Cost Basis Allocation

Step 6) Allocate Remaining Cost Basis Cost basis for BTC and ETH “Returned is as follows:

Cost basis allocation for remaining categories is as follows

Step 7) Calculate Loss/Gain on Distribution

Step 8) Cost Basis Reserved for Future Distributions

Example #2 – Received More BTC and More ETH Than Initially LostScenario: You lost 0.25 BTC, 2.5 ETH, and 50,000 USDC with cost basis of $2,500, $1,250, and $50,000 respectively ($53,750 total). Your total claim is $60,575.21 calculated using the petition prices linked in the “Understanding Your Claim Value” section with the 5% markup added. You receive 0.408082 BTC, 6.805015 ETH, and 451 shares of Ionic stock in 2024. Follow the steps. Step 1) Identify “Returned” BTC and ETH vs “New” BTC and ETH Returned BTC = 0.25, New BTC = 0.158082, Returned ETH = 2.5, New ETH = 4.305015. Step 2) For “Returned” BTC/ETH, Identify Cost Basis Returned Since 100% of both the BTC and ETH were returned, the full cost basis of each is assumed for the “Returned” amounts. The “Returned” BTC keeps the $2,500 cost basis and the “Returned” ETH keeps the $1,250 cost basis. Step 3) Identify Remaining Cost Basis to be Allocated $53,750 total cost basis – $2,500 – $1,250 = $50,000 remaining Step 4) Determine Starting Percentages for Allocation for Remaining Categories

Step 5) Calculate the Final Percentages for Cost Basis Allocation

Step 6) Allocate Remaining Cost Basis Cost basis for BTC and ETH “Returned is as follows:

Cost basis allocation for remaining categories is as follows

Step 7) Calculate Loss/Gain on Distribution Reminder, the FMV is determined using the effective date prices on 1/16/2024 as shown in “Distribution Payout Structure” section above.

Step 8) Cost Basis Reserved for Future Distributions

Comments on ExamplesIn total, there are 16 different types of scenarios. While the two examples above show the calculation for receiving both more BTC and ETH and less BTC and ETH for low cost basis scenarios, you can of course have a mismatched scenario where you receive more BTC and less ETH or vice versa. However, if you just follow the instructions the calculation should stand up against any of the 16 possible scenarios outlined below. Closing RemarksAll in all, the Celsius calculation is far from simple. With so many moving parts, it feels like playing multi-dimensional chess. Each solution I came across online often worked well with 1 of the 16 scenarios. However, after trying to apply it to the rest it would fall apart at some point. The solution I have provided and outlined above is universal and can be used for any and all of the possible scenarios. It is comprehensive and granular to the point someone can perform the calc for themselves on their own. Unlike others, I don’t want to gate-keep this calculation from the hundreds of thousands of people impacted by the bankruptcy. If you are a CPA/tax professional and have critiques to my method outlined above, I encourage you to please comment below and share your thoughts. Knowledge sharing is very important in this space. Feel free to ask any questions below and I’ll try to answer them. Thanks for reading. JustinCPA submitted by /u/JustinCPA |

Categories