|

The Market is seeing a strong correction with Bitcoin down over 25% over the past week. Looking at my portfolio hurts and it’s clear this sub is in distress. What usually helps is putting price into perspective using long-term risk models. I’ve posted this compilation of my private and public indicators before and people have always enjoyed them. So here’s another one and I hope it helps keep the uncertainty at bay. We’ll be calculating a weighted risk score based on several reputable models and indicators. Keeping in mind that:

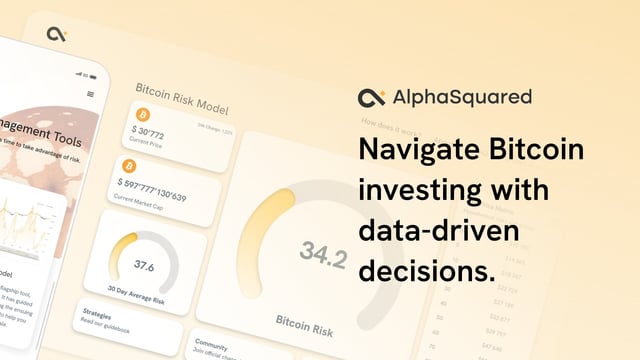

To gauge the overall market risk, we’ll be using the following indicators, each with differing weights: Alphasquared (link) – 40%

Benjamin Cowen (YouTube) – 30%

RSI (link) – 20%

CBBI (link) – 10%

Now, let’s combine all of these

Verdict In conclusion, by combining insights from multiple models and indicators, we’ve calculated an overall weighted risk score of 31.69 out of 100 for the current BTC market conditions. While no single metric tells the whole story, this can help us put things into perspective so we can judge when to take profits, keep DCAing etc. Just for good measure, models are tools, not crystal balls. The best you can do is build your strategy around them, like setting buy and sell points scaling up and down with risk. With this in mind, I hope this post is appreciated. I’ll keep updating you guys as long as these are well-received. I’m more at ease looking at these indicators and simply increasing my DCA this week. submitted by /u/AlexWasTakenWasTaken |

Categories