Source: https://x.com/Syndica_io/status/1833970697766662346

1/ August saw significant growth in @Solana DeFi, with both SOL Locked in DeFi and Perp DEX Volume reaching ATHs.

Meanwhile, interest in memecoins has finally slowed after a dominant year.

Dive into on-chain data in our full thread and report

https://blog.syndica.io/deep-dive-solana-defi-august-2024

https://preview.redd.it/g26nbpfecfod1.png?width=680&format=png&auto=webp&s=9ec1c1edf4f152f37b0fb3295b366718360b4f12

2/ SOL locked in @Solana DeFi protocols reached an ATH of 7.6M.

@RaydiumProtocol commands the highest amount of SOL locked among DeFi protocols, with Jupiter Perps a close second.

https://preview.redd.it/t63maafhcfod1.png?width=680&format=png&auto=webp&s=6f1d9bd21b42f8ed88f8b9375b55ce978cb27a32

3/ Including liquid staking, SOL locked in @Solana DeFi hit an ATH of 33M.

Currently, 5.7% of the entire SOL supply is locked in DeFi.

https://preview.redd.it/eniew5ejcfod1.png?width=680&format=png&auto=webp&s=7fd809eb079bd980cc722ce7834e46ce452e13fc

4/ The DEX market cooled in August.

DEX volume has declined by 31% to settle at $48B.

https://preview.redd.it/terart7lcfod1.png?width=680&format=png&auto=webp&s=6a98c8fcc6c4c4715b8bb13a00d388e8e24a625e

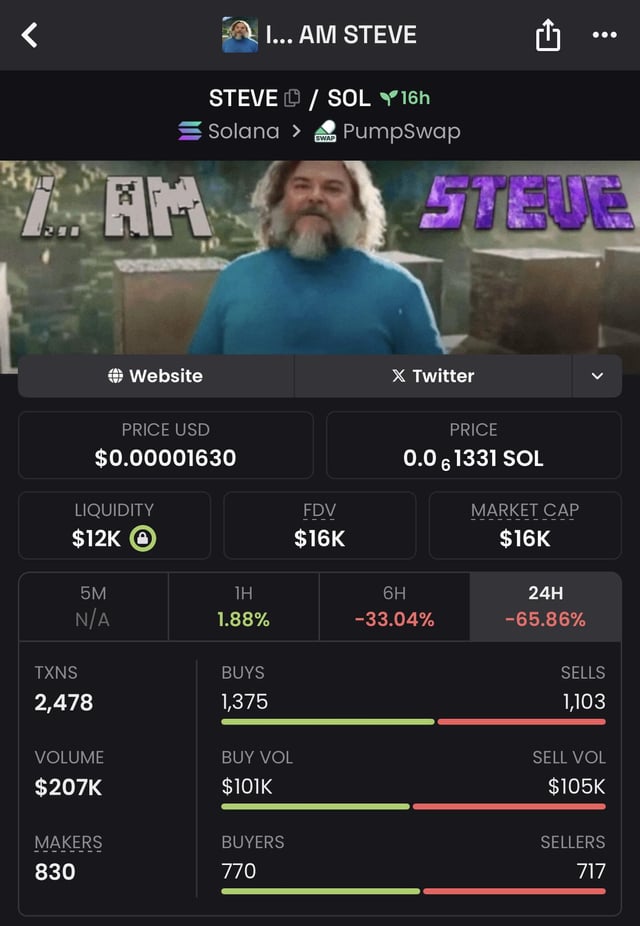

5/ Interest in memecoins tapered.

Memecoins, which previously dominated spot DEX volume, now account for a little under half of all DEX volumes.

https://preview.redd.it/hpi4hh1ncfod1.png?width=680&format=png&auto=webp&s=f42ac103f4cd43769371673f140f42440f15f166

6/ The memecoin market is showing signs of exhaustion.

To date, 1.92M cumulative unique memecoins have been launched on @pumpdotfun, with the rate of new token creation cooling from the May high.

https://preview.redd.it/eipd107pcfod1.png?width=680&format=png&auto=webp&s=9e9db18658c82f5660931a58d048577175878f5a

7/ About 99% of the memecoins launched on @pumpdotfun fail to reach Raydium.

Despite new memecoin launches each month, most fail to achieve the $69k market cap required for “graduation” & listing on Raydium.

https://preview.redd.it/drww53drcfod1.png?width=679&format=png&auto=webp&s=b43c3597818148e133877f577268875ce7f027a8

8/ @JupiterExchange Perps’ volume reached a new ATH of $17.5B.

The protocol has adjusted its fees to remain competitive with CEXes.

https://preview.redd.it/c1op7qitcfod1.png?width=680&format=png&auto=webp&s=892812433bb95aec5f2c9850dc7653bc821be3c3

9/ @Solana Perp DEXes are growing at a blistering pace.

TVL on perp DEXes has also reached a new ATH of 8.2M SOL, growing almost 4x since January.

https://preview.redd.it/uflz21ovcfod1.png?width=680&format=png&auto=webp&s=8a2985f55bf51b121bc7961d8a9383d45d5785c8

10/ @DriftProtocol‘s BET prediction market has already shown signs of PMF.

Launched on August 19th, the new betting platform saw nearly 6k bets placed in its first two weeks.

The most active market focuses on whether Trump will win the 2024 US Presidential Election.

https://preview.redd.it/kf64nmlxcfod1.png?width=680&format=png&auto=webp&s=80c18527dec3d233e6b22d69ad2d2360efab8209

11/ @Solana Lending TVL reached a new ATH of 14M SOL.

TVL broke through a 5-month stagnation period with a surge from @KaminoFinance.

https://preview.redd.it/qs50chszcfod1.png?width=680&format=png&auto=webp&s=2c3c8aab32ef65d78898b9c62f44d4034f63ca54

12/ @KaminoFinance has continued to dominate Solana lending.

The protocol commands over two-thirds of overall lending TVL share.

https://preview.redd.it/dh896id2dfod1.png?width=680&format=png&auto=webp&s=6b615c3dc96efa3cde6d21ed2804a8062b22a32a

13/ The lending market follows a ‘winner-takes-most’ dynamic.

Both Aave (ETH) & Kamino (SOL) command over 2/3 of the lending TVL share on their respective blockchains.

Benefiting from a network effect, higher TVL makes platforms appear safer, attracting more users & deposits.

https://preview.redd.it/1z1m9ga4dfod1.png?width=680&format=png&auto=webp&s=8ff3d234dc120e914b905ce77b1d72d17f4b887a

14/ @Solana stablecoin market cap has returned to pre-FTX levels.

Stablecoin adoption has steadily increased throughout 2024, completing a resurgence two years in the making.

https://preview.redd.it/ecvjmna6dfod1.png?width=680&format=png&auto=webp&s=5688ad158fb0da970c995fc0b342ff5a97657867

15/ PYUSD experienced its first pullback.

Market cap peaked at $647M before experiencing its first notable drawdown to $561M.

This can be attributed to a decline in PYUSD incentives across various DeFi protocols.

https://preview.redd.it/ld2uaie8dfod1.png?width=680&format=png&auto=webp&s=5a348168c4e7a8992c26bdc958047b744014ff65

16/ @Orca_so, @DriftProtocol, and @marginfi have emerged to capture more PYUSD supply distribution.

86% of PYUSD is held in DeFi protocols, with @KaminoFinance still commanding 68% of all PYUSD supply.

https://preview.redd.it/1praacbbdfod1.png?width=680&format=png&auto=webp&s=867bbc01c5d8991f0859c978e334188fbddc50ea

17/ @Solana‘s PYUSD supply now exceeds its Ethereum counterpart.

https://preview.redd.it/reccdlpddfod1.png?width=679&format=png&auto=webp&s=90fe9b1639ba62e43774d156b6938c51e8b50112

18/ @UseLulo‘s directed liquidity hit a new ATH.

MoM growth continues to skyrocket for Lulo’s directed liquidity, hitting $34M.

PYUSD became the most directed asset on the platform, surpassing USDC.

https://preview.redd.it/rb9dhh9gdfod1.png?width=680&format=png&auto=webp&s=432e43533af073711f35b11702c2ca850a54699d

19/ @Sanctumso LSTs pushed liquid-staking TVL past the 25M SOL mark.

17% of the total liquid staking TVL is comprised of Sanctum LSTs.

Keep an eye on this figure as Tier-1 CEXes like @Binance and @Bybit_Official launch their own Sanctum LSTs.

https://preview.redd.it/hxrgywwidfod1.png?width=680&format=png&auto=webp&s=1a6ce2146c200ed0c0efa3036707d16e827cb105

20/ Our August projects to watch include @RenzoProtocol expanding to Solana, @TheVaultFinance,

@Pathfinders__, and @DeFiCarrot.

https://preview.redd.it/3fbl3ikldfod1.png?width=680&format=png&auto=webp&s=801c733fe02ef22101ee594b8650f607188ec45c

21/ Read the full report to learn more:

https://blog.syndica.io/deep-dive-solana-defi-august-2024